Purchasing Properties in Vietnam as a Foreigner

Purchasing properties as a foreigner is the most myriad of foreigners living in Vietnam seek recently.

Who are eligible?

Vietnam’s 2014 Law on Housing took effect July 2015. Since then, a classification of foreigners who are eligible to purchase property in Vietnam expanded[1] to include:

5 eligible persons to purchase properties in Vietnam

5 eligible persons to purchase properties in Vietnam

frequently-asked questions

Therefore, it is not necessary NOW to ask whether or not foreigners are eligible to purchase property in Vietnam. Instead, frequently-asked questions that CNC receives, daily are:

3 most frequently-asked questions

3 most frequently-asked questions

Matter-of-factly

The possibility of foreigners purchasing property in Vietnam remains challenging – having too many hurdles for most foreigners to navigate.

These clear and, hopefully, concise answers aim to provide foreigners with the established comprehensive methods of purchasing property in Vietnam and ensure they select one that is most suitable for them.

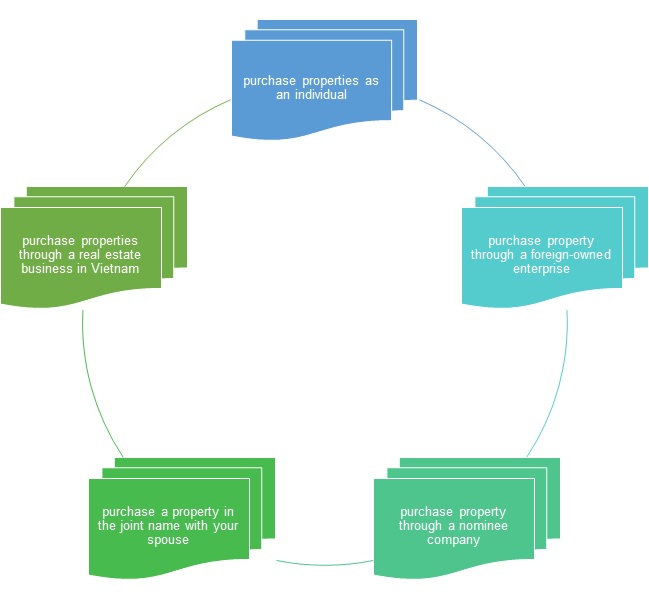

Ways to purchase properties in Vietnam

Ways to purchase properties in Vietnam

The first option is to purchase property as an individual

Legislation now allows “anyone who has valid documentation (permitted to enter Vietnam), except diplomatic immunity and privilege) is eligible to purchase property in Vietnam.” This means that, regardless of permanent or temporary residence status in Vietnam, foreigners will always have the rights to purchase property.

The purchase of property under this arrangement is, however, most suitable for expats who are currently living or working in Vietnam on a long-term basis.

The property may be leased, but the owners of the property must inform the provincial house management agency before leasing the property. Subsequently, the owners are subject to the payment of appropriate property taxes.

The limited time of ownership imposed on this method is no longer 50-years. The terms of ownership are set in the purchase agreement and under no circumstances will it last longer than 50-years, but may be renewed prior to the expiration date or transfer it to a third party.

Exact conditions for extensions are yet to be enacted and will be further regulated in the future.

Last but, not least, the owner of this property is only allowed to purchase a certain amount of property – e.g. less than 30-percent (30%) of apartments in one apartment building, or less than 250 separate houses, including villas and row houses in areas where the population is equivalent to a ward or administrative division.

The second option is to purchase property through a foreign-owned enterprise

Foreign-owned enterprises in this context involves both 100-percent (100%) foreign-owned enterprises or any joint venture enterprises irrespective of 1% to 100% foreign capital proportion.

Understanding how a foreign-owned enterprise could be registered/incorporated, foreigners might find it interesting to consider how the individual property ownership method works. Likewise, foreign-owned enterprises may only purchase certain properties – apartments, villas, detached houses, or row houses under commercial construction-based projects. Property purchased in this manner must be used for accommodating employees of the enterprise(s) (in most likely, the owner of the foreign-owned enterprise), but not for leasing purposes.

The third option is to purchase property through a nominee company

A nominee company is a company established by a local partner, but the operation, management of, and true owner in fact of the company, is the foreign partner. The article “The investment in Vietnam through nominee structure” helps foreigners understand how this arrangement works.

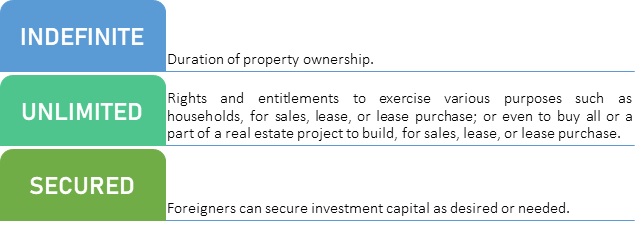

Advantages

As nominee company is locally-owned by Vietnamese citizens and foreigners will enjoy a plethora of benefits that all Vietnamese citizens are entitled to., which include, but not limited to, the following:

Advantages of purchasing properties through a nominee company

Advantages of purchasing properties through a nominee company

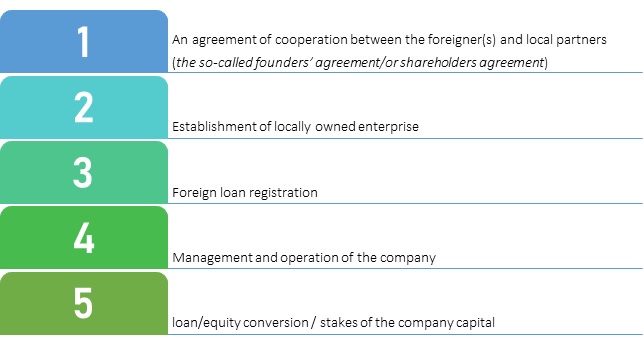

Disadvantage

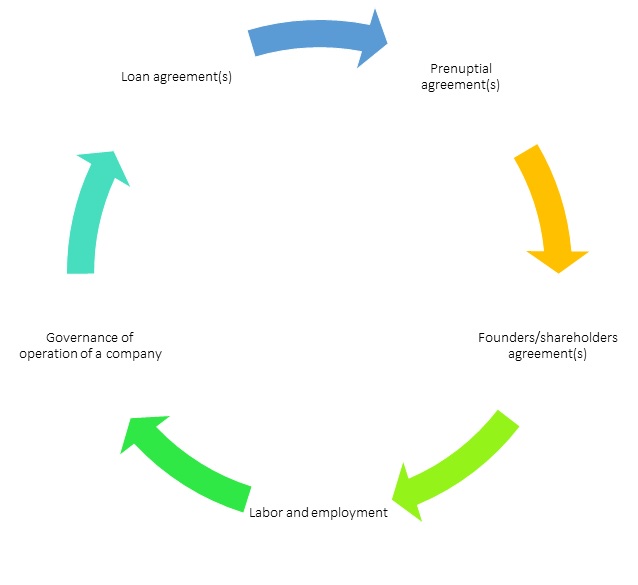

The only disadvantage is that this method requires a wide variety of works to be executed, all to secure the foreigners’ interests. The related paperwork in this way include:

Disadvantages of purchasing properties through a nominee company

Disadvantages of purchasing properties through a nominee company

The fourth option is to own a property in the joint name with your spouse

Vietnam’s Law on Housing provides for foreigners married to a Vietnamese national will exercise the same rights, obligations, and privileges as Vietnamese citizens.

Exercising this entitlement right, requires that the foreigner complete and submit all necessary paperwork, which includes registration at the department of justice, consulate legalized documents for use in Vietnam, etc.

Prior to (or promptly after) the fulfillment of the marriage requirements, the foreign partner and spouse must construct a pre-nuptial agreement to separate the property should dissolution of marriage occur.

Care must be taken to ensure each party separates relationship and property matters should a termination of marriage status occur. Premarital/prenuptial agreements analyzed here are a must-used legal mechanism.

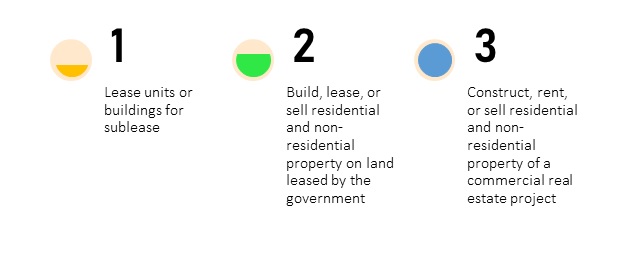

Last but not least, to set up a real estate business in Vietnam

Unlike most of the aforementioned methods of acquiring property ownership Vietnam, establishing a real estate business in Vietnam will help investors to

Setting up a real estate company in Vietnam

Setting up a real estate company in Vietnam

With respect to the real estate sector, Vietnam is committed to opening its market to all members of the World Trade Organization (WTO). Foreigners/investors can register a 100-percent (100%) foreign-owned enterprise and acquire real estate business lines to conduct business.

Unlike others, doing business in real estate requires the owner to meet a minimum capital requirement – currently 20-billion VND (approximately $880,000.00 USD). Investors are required to contribute this amount within 90-days – paid via an investment account – upon establishing the company. To select a suitable account for this, please read this article in its entirety.

Streamlining the capital

Structuring a proper streamline of capital investment might be the most important question investors consider prior to allocating money in any option.

In the worst-case scenario, how the capital is streamed potentially helps to secure the interest of the investor via return on investment or at least, entitle investors to a viable mechanism to a return on investment through the legal process.

Depending on how investors purchase properties, capital can be streamed through the following mechanisms:

How to stream the capital to purchase properties in Vietnam

How to stream the capital to purchase properties in Vietnam

What documents are a buyer (buyers) required to have before agreeing on any deposit agreement or purchase agreement?

It is highly recommended that investors obtain/retain legal counsel to accompany them while considering or entering into any transaction, e.g. a deposit agreement (or the like), or the sale/purchase agreement.

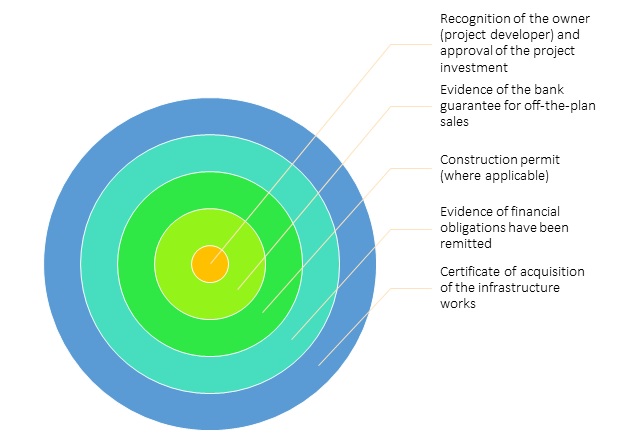

Most often, foreigners purchase on an off-the-plan sale contract – a contract takes place before the real property is to be handed over to the foreign buyer(s). Therefore, documentation justifying the project developers’ entitlement to sell the property become most important. These documents will normally include:

Document justifying the project developers’ entitlement to sell properties

Document justifying the project developers’ entitlement to sell properties

Foreigners must decipher the listed vital documents from what they receive from the project developer’s agent, the brochure, and leaflet. These documents are generated by the project developers for marketing purposes only and do not form any legal basis for which foreigners to rely upon and make a claim against the project developers in the future, should they discover discrepancies or moral turpitude.

Let’s take recognition of the owner and approval of the project investment as an example. This document serves as a benchmark to determine (i) who eventually is/are the project developer(s) – meaning who is entitled to collect money from the buyers/purchasers; (ii) what the objective(s) is/are of the project, i.e. for commercial, sales, leasing, or for resettlement and compensation purpose.

What notable issues should a buyer bear in mind while entering into a purchase agreement?

As such, remember, “what’s been written binds the writer”.

Upon review of all necessary information and finding that the target project is a great option to purchase, allow appropriate time to consider all information before entering into an agreement.

Management and miscellaneous fees excluded from the contract price

There are at least 30 fees that are normally excluded from the contract price and which include (i) parking fees; (ii) utility (gas, electricity, water, etc.) fees; (iii) insurance (property, liability, house, etc.) fees; (iv) other facilities.

Fee rates vary greatly from project to project. Some project developers include these fees in the contract price for the first few years, but some do not, and the fees could present an issue.

Out of the most important is the fee to apply for the pink book. It could be five-percent (5%) of the contract price. Therefore, buyer should not forget to check it.

The net actual size of the apartment unit

As an off-the-plan sales contract, the project developers tend to either (i) decrease the net actual size of the apartment; or increase the gross size of the apartment.

Those situations aim at mitigating the risk of handing a smaller size of the apartment unit or to ask purchasers to pay the gap between the off-the-plan size and the net actual size measured at the time of acquisition.

Depending on the scale of the apartment unit, project to project and project developers to the others, if the gap between the off-the-plan size and the actual measured size exceeds a certain square, typically one-percent (1%), the buyers/purchasers are required to pay the gap.

Issuance of the Pink Book

Legislation provides that within fifty-days (50-days) from the acquisition date of the apartment unit, the project developers are required to obtain the pink book from the competent authorities, but due to a number of reasons, the issuance of the pink book is either (i) left indefinite in the sales/purchase agreement; or (ii) subject to conditions which are not the purchasers to manage or be held responsible for.

Those conditions are:

A dispute between the contractor and the project developer – where the contractor does not furnish the as-built drawing; and/or other operation manual; to enable the project developer to prepare its dossiers and obtain the pink book;

Non-compliance of the project developers to the approved design or other requirements;

Failure of the project developers to fulfill financial obligations; and

A delay in processing by the competent authorities;

Any delay, on the part of the Competent Authorities, in issuing the pink book, will likely result in the purchasers, buyers, owners being adversely affected – i.e. unable to secure a mortgage.

Getting started

Get in touch with us today via hi@gate2v.com or call us at +84-28 6276 9900 hotline +84 916 545 618 if you wish to purchase properties in Vietnam to ensure possibly potential risks are properly eliminated.

CONTACT US

Arthur Le | Managing Partner

T: (+84-28) 6276 9900

Nguyen Thi Kim Ngan | Senior Associate

T: (+84-28) 6276 9900

GATEWAY TO VIETNAM© | A Boutique Law Firm

28 Mai Chi Tho Boulevard, An Phu Ward, Thu Duc City,

Ho Chi Minh, Vietnam

T: (+84-28) 6276 9900 | Hotline: (+84) 916 545 618

hi@gate2v.com | https://gate2v.com

Disclaimers:

The content herein does not reflect any legal perspective of Gateway to Vietnam or any of its partners in the past, present or future. This newsletter is not considered to be accurate and/or suitable for legal issues encountered by clients. In no way does this newsletter constitute a service agreement between Gateway to Vietnam and client. Gateway to Vietnam objects all liability arising from or relating to client’s quoting any content of this newsletter to apply to their own issues. Clients are encouraged to ask for legal advice for each specified circumstance they encounter.

[1] See Article 159 [Subjects entitled to own houses and forms of ownership of foreign individuals, organizations in Vietnam], Law on Housing 2014.

Download this article in pdf version here.