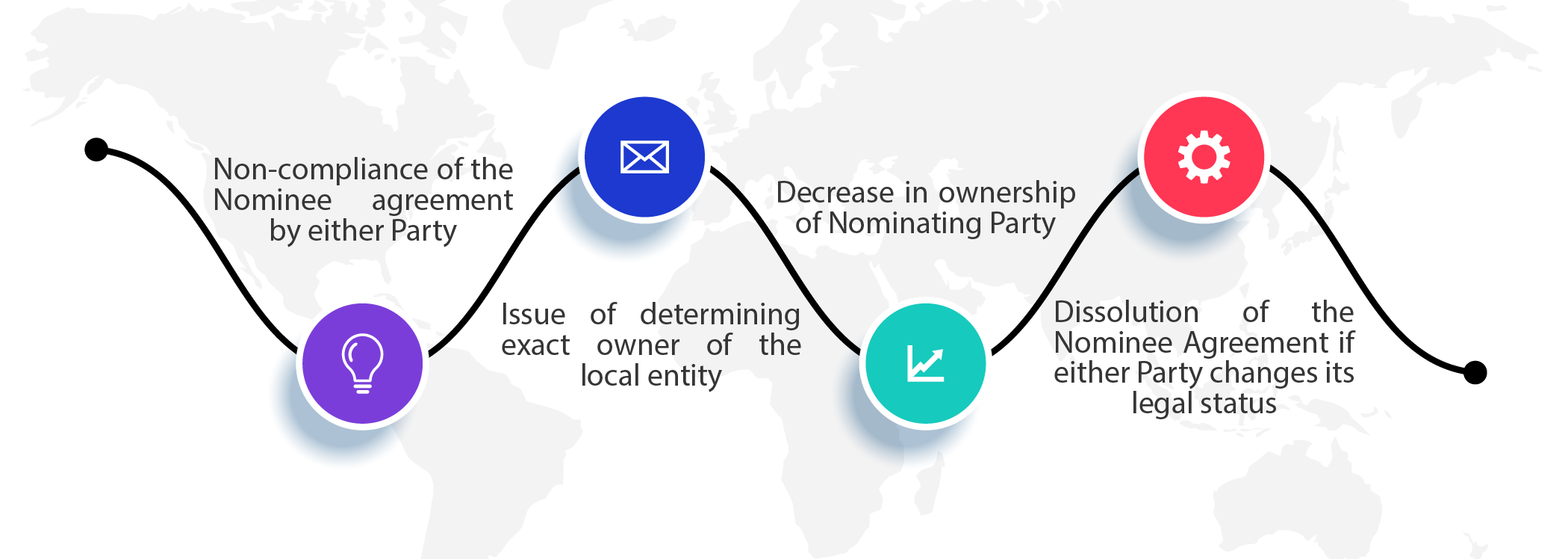

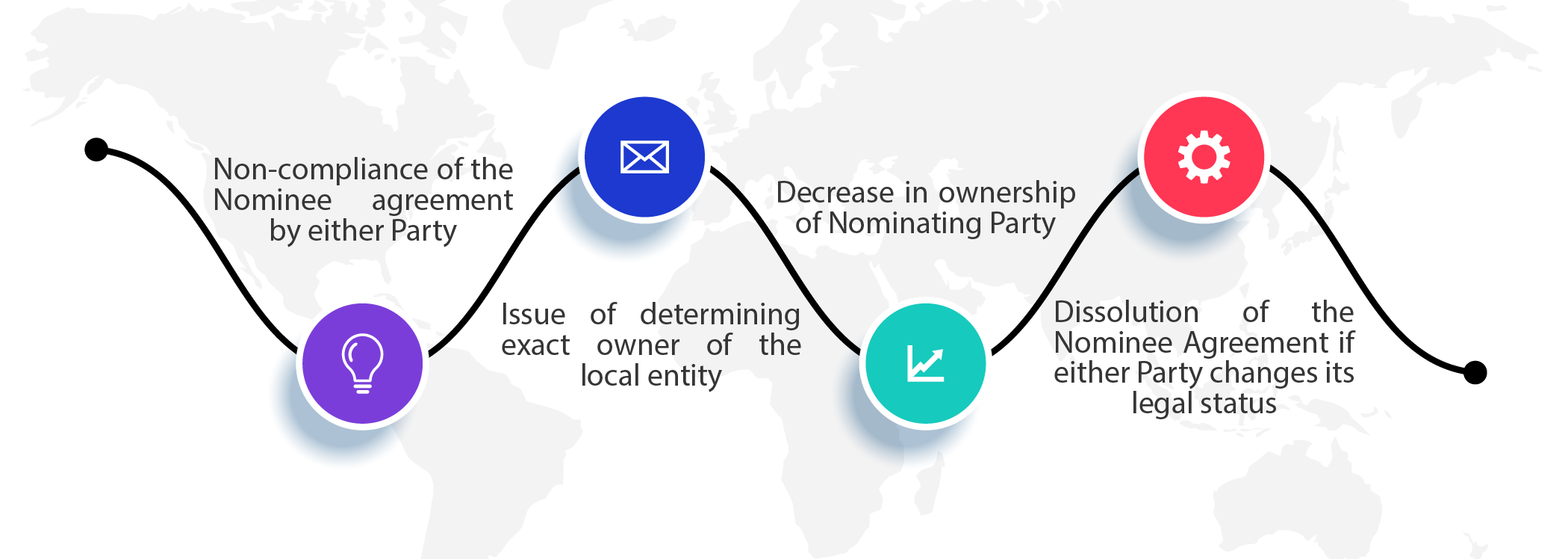

Nominee Structure Risks and Drawbacks

Nominee Structure Risks and Drawbacks

6. Founder’s Agreement (Shareholders Agreement) Legal Status

In developing countries like Vietnam, Myanmar, Cambodia, Laos, China or in the emerging countries having received significant global investments, the legal status and validity of the founder’s agreement (shareholders agreement) pertaining to the investment arrangement become issues.

Vietnam as an example, established Civil Code 2015 (taking effect on 01/01/2017) which respects the freedom of Parties to negotiate, enter into any contract, and allow such agreement to have legal effect so long as said agreement is in agreement with public interest and/or does not breach the principle rules of Vietnam.

Moreover, the founder’s agreement (shareholders agreement) is determined to be invalid if the Parties of the transaction intend to conceal another illegal transactional arrangement. Therefore, civil transaction arrangements made under false pretenses, concealing another transaction, or avoiding the performance of another obligation towards a third party, is invalid.[1]

Wherefore, while preparing or adjusting the terms of the founder’s agreement (shareholders agreement), relevant factors as to the effectiveness and validity of the agreement must be taken into account thereof.

An attitude of dignity will provide each Party with an understanding of what each item or issue will be considered as sensitive. Avoiding and mitigating the consequences of sensitive issues must be outlined in the contract.

Vietnam law, neither in caselaw or precedent, lacks defining provision of the element of a false transactional arrangement. There is nothing to distinguish between or provide clarity of the validity or invalidity of a specific matter in the founder’s agreement or the shareholders agreement. Once a dispute has arisen, each Party must endeavor (depending on position thereof) to prove such agreement is valid or invalid.

7. Practical Legal Solutions

Established on the grounds of cooperation, trust, and agreement between the Nominee Party and the Nominating Party, this Nominee Structure recommended in limited situations as described (i) to investigate the market and test the business model to ensure feasibility in a foreign country; (ii) to overcome restrictions and limitations imposed by the host country upon foreign investors; or (iii) to settle short-term impediments that the Nominating Party could not arrange at the time of the Nominating/investment.

With exception of the foregoing circumstances, Parties are advised to select other investment mechanisms available to them (such as setting up a foreign-invested enterprise, purchase of an existing company, business cooperation contract), in an effort to secure its best interests.

On a short-term basis, relevant labour and employment regulations are considered to be a good tool which helps Parties to flexibly apply for their own relationship to supervise, manage, and monitor the operation of defined purposes.

Succinctly, the Nominee Structure is a good option as long as that all care is taken by each Party to discuss each minute detail of any and all aspects before making any decisions. Nevertheless, lawyers contribute valuable advice or arrange a structure that best equips the Parties’ relationship.

Taking everything into consideration, the Nominee Structure requires competent authorities to have better administrative management to support investment in Vietnam while ensuring accountability and oversight.

CONTACT US

Arthur Le | Managing Parter

T: (+84-28) 6276 9900

E: arthur.le@gate2v.com

Nguyen Thi Kim Ngan | Senior Associate

T: (+84-28) 6276 9900

E: ngan.nguyen@gate2v.com

Gateway to Vietnam© | A Boutique Law Firm

28 Mai Chi Tho Boulevard, An Phu Ward, Thu Duc City,

Ho Chi Minh, Vietnam

T: (+84-28) 6276 9900 | F: (+84-28) 2220 0913

gate2v.com | hi@gate2v.com

[1] Civil Code 2015, Article 124.

Investment in Vietnam through Nominee Structure

Investment in Vietnam through Nominee Structure Circumstances whereupon the nominee structure is selected

Circumstances whereupon the nominee structure is selected

a step-by-step procedure of how the Nominee Structure operates

a step-by-step procedure of how the Nominee Structure operates Nominee Structure Benefits

Nominee Structure Benefits Nominee Structure Risks and Drawbacks

Nominee Structure Risks and Drawbacks