1. Introduction to a foreign-invested company

Foreign investors can set up a foreign-invested company to perform an investment project in Vietnam in almost every sector.

Thank to Vietnamese Government’s recent efforts to lure FDI capital into Vietnam, the direct investment capital flow into Vietnam has steadily expanded(1).

The demand for legal guidance along with the foreign investment thereof is increasing. Therefore, Gateway to Vietnam prepare this insightful article “setting up a foreign-invested company in Vietnam” for the interests of international investors whose ideas are to set up a foreign-invested company or to purchase shares of the existing company in Vietnam.

2. What is a foreign-invested company?

Foreign-invested companies (or foreign-owned enterprise) are those companies established by foreign investors to perform investment activities in Vietnam.

According to Vietnamese legislation, foreign-invested companies having 100-percent foreign ownership must be established in the form of limited liability companies (LLCs), joint stock companies (JSCs), or partnerships.

See 5 types of companies in Vietnam here.

2. What is a foreign-invested company?

Foreign-invested companies (or foreign-owned enterprise) are those companies established by foreign investors to perform investment activities in Vietnam.

According to Vietnamese legislation, foreign-invested companies having 100-percent foreign ownership must be established in the form of limited liability companies (LLCs), joint stock companies (JSCs), or partnerships.

See forms of company in Vietnam here.

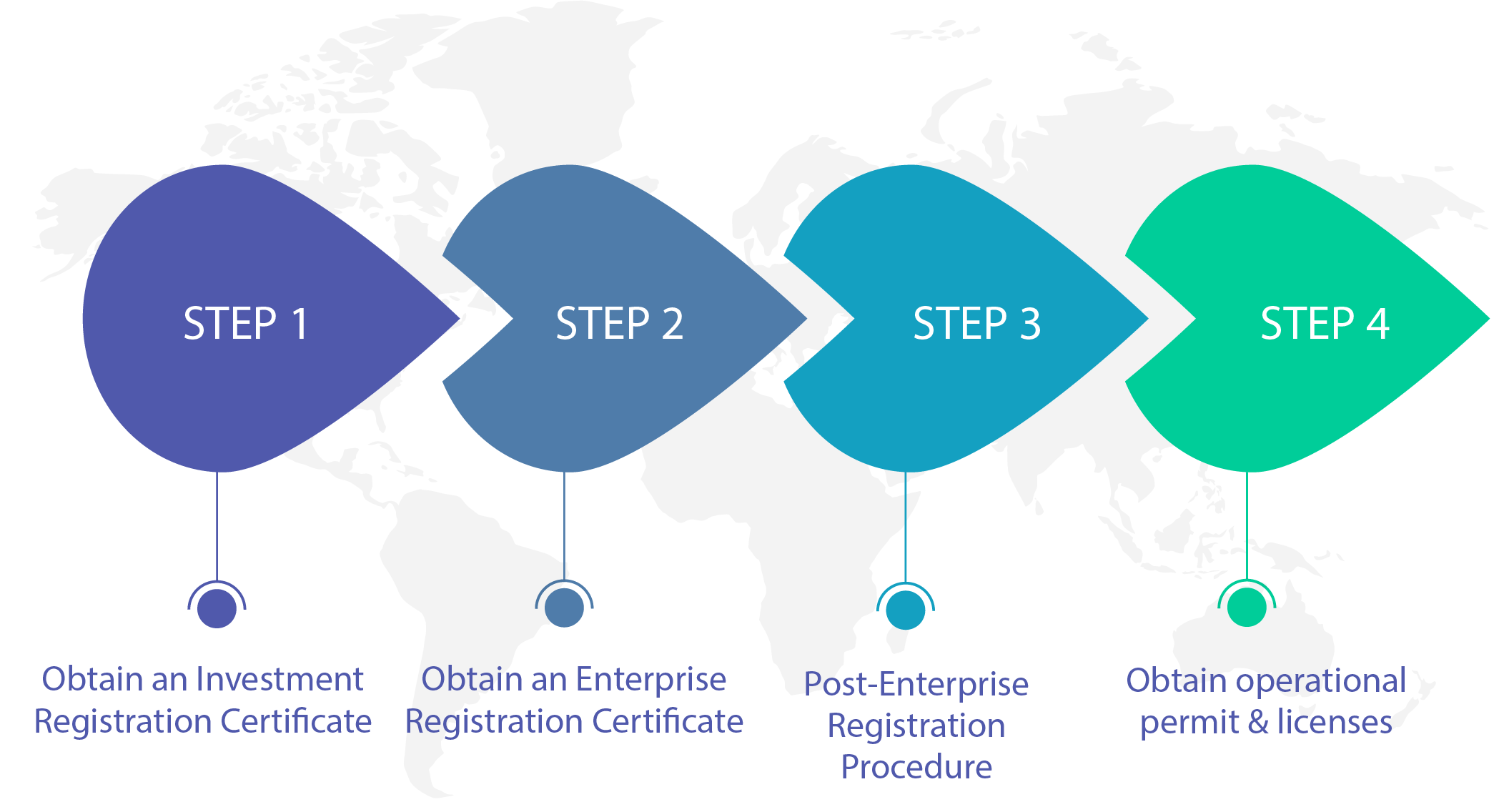

3. Procedure to set up a foreign-invested company

Foreign investors typically encounter the following procedures to start a business in Vietnam:

Step 1: Obtain an Investment Registration Certificate

Step 2: Obtain an Enterprise Registration Certificate

Step 3: Post-Enterprise Registration procedure

Seal sample

Order token

Submit initial tax dossier.

Open a bank account.

Order electronic invoices.

Submit License tax.

Step 4: Obtain operational permit & licenses.

Procedure to start a business in Vietnam

Procedure to start a business in Vietnam

It is worth noting however that the above procedure does not include an exceptional situation where investment projects are required to obtain approval – by the provincial People’s Committee, the Prime Minister, or the National Assembly – according to the investment guidelines.

4. Applying for an Investment Registration Certificate

Applying for an investment registration certificate is the first, unequivocally and foremost step of realizing an investment project in Vietnam. The aim of this step is to obtain Vietnam’s recognition of a foreign investment project.

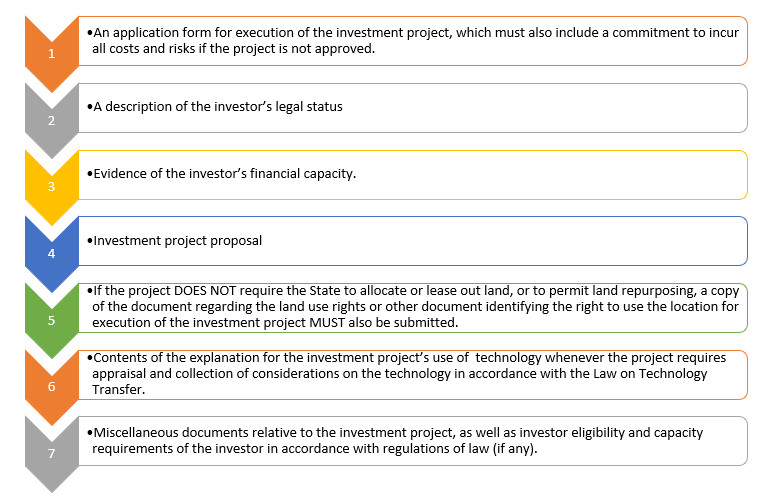

4.1. Document Preparation

A complete application dossier comprises of various documents, which can be categorized into

An application form for execution of the investment project.

A description of the Investor's legal status.

Evidence of the investor's financial capacity

Investment project proposal

A copy of the document regarding land use rights or other document identifying the right to use the location for execution of the investment project.

An explanation to the investment project's use of technology if the project requires appraisal and collection of considerations on the technology.

Miscellaneous documents relative to the investment project, as well as investor eligibility and capacity requirements of investors.

a typical profile composition of an investment project

4.2. Competent Authorities

Once the application dossier has been well-prepared, it should be submitted to competent authorities to obtain the investment registration certificate.

Depending on the place upon which the investment project is intended to register, the application should be submitted to the following competent authorities

The Industrial Park Management Board - whenever the company is located in an industrial park.

The Department of External Economic Relations – Provincial Departments of Planning and Investment – whenever the company is located outside an industrial park.

4.3. Timeline

Legitimate timeline for competent authorities to examine the application and to grant the Investment Registration Certificate is 15 days after the submission date.

It is, however, that timeline to obtain an Investment Registration Certificate depends on various factors, including the sufficiency of the application, the area of practice, the competent authorities’ viewpoints on a specific issue (if any). As such, light delay should be anticipated.

Practical experience indicates that it takes 15 – 30 business days, on the average to obtain an Investment Registration Certificate.

5. Applying for an Enterprise Registration Certificate

Promptly upon obtaining the Investment Registration Certificate, investors must prepare documents to obtain an Enterprise Registration Certificate to establish a company.

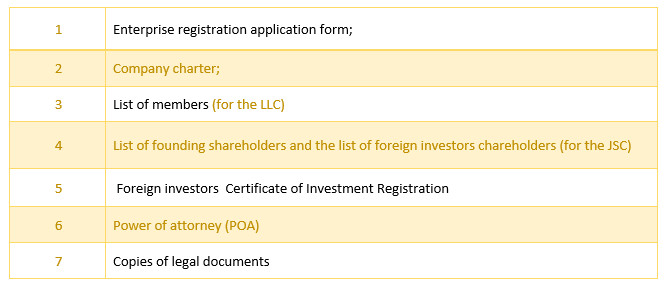

5.1. Document Preparation

Document preparation for this step becomes easier than the previous stage as it generally speaking, involves only those documents that can produced within Vietnam.

In particular, the documents needed to prepare include:

Enterprise registration application form

Company charter

List of founding shareholders and list of foreign investor shareholders

Foreign investors' certificate of Investment Registration

Power of Attorney (POA)

Copies of legal documents

The application for enterprise registration certificate as foresaid mentioned can be submitted directly to the Business Registration Office, via postal service or portal system.

5.2. Competent Authorities

Submit an application for an enterprise registration certificate for a company with 100-percent foreign capital at the business registration authority – Department of Planning and Investment.

Allow a duration of 5-business days from the date of submission (provided the dossier is complete and valid) for the registration certificate to be issued to a company with 100-percent foreign capital.

6. Post-Enterprise Registration Procedure

Following the receipt of the enterprise registration certificate, the investor will further complete additional procedures such as filing an initial tax return, stamp engraving, purchasing digital signatures, issuing invoices, opening a bank account, etc., prior to initial commercial activities.

Filing an initial tax return

As soon as practicable, but not later than January 31 of succeeding calendar year.

stamp engraving

Est. $15 - 30$

purchasing digital signatures

Est. $50-$70 annually

issuing invoices

Est. $30-$50/1,000 invoices

opening a bank account

Est. $50 deposit

7. Operational Permits & License

Last but not least, don’t forget to consult your legal advisor(s) to see if law requires any special permit, license, approval before your venture could eventually operate.

Some of the common permit, license, or approval required under law of Vietnam are

8. Contact Us

As previously stated, forming a 100-percent foreign-owned corporation in Vietnam is a challenging process. Investors must meet industry, business, and capital requirements.

Any and all concerns or requirements for assistance, may be directed to our experienced team of legal experts. Please contact us at +84-916-545-618 or email us at arthur.le@gate2v.com and hi@gate2v.com for prompt and courteous service.