A Foreign-invested business organization is an organization whose members or shareholders are foreign investors.

A Foreign investor is an individual holding foreign nationality or an organization established under foreign laws and performing business investment activities in Vietnam.

1. Why invest in Vietnam?

Vietnam is considered an economic bright spot in Southeast Asia based on its impressive economic growth and attractive foreign direct investment (FDI). Vietnam continues to present itself as an appealing destination for foreign investors. Listed below are a few reasons for establishing a foreign-invested enterprise in Vietnam.

Advantageous geographical location

A long coastline, adjacent to the East Sea with convenient access to the world’s primary shipping routes, is a particularly important condition for trade.

Vietnam, in the center of Southeast Asia with two major cities: Hanoi and Ho Chi Minh City. Hanoi, is situated in the north and possesses favorable business opportunities. Meanwhile, Ho Chi Minh City is located in southern Vietnam and is considered the largest technological region of Vietnam.

1.2. The political situation is stable

Vietnam’s political stability is one of the most magnificent factors for the Investors. Compared with other countries, it is evident that Vietnam’s political climate is stable, ensuring consistency in economic development policy and foreign investment attraction.

1.3. A steady and growing economy

Over the years, Vietnam has been one of the fastest growing economies in Asia. Belonging to the group of high-growth countries in the region, Vietnam’s average GDP growth rate is rapidly increasing – GDP growth is expected to reach approximately 5.9-percent per year. GDP increased 2.4 times, from 116 billion USD in 2010 to 268.4 billion USD in 2020. GDP per capita increased from 1,331 USD in 2010 to about 2,750 USD in 2020.

Noteworthy, Vietnam ranks 41st in the ranking of major contributors to the global economy in 2021, with $0.4 trillion, accounting for 0.4-percent of the total global GDP.

1.4. Vietnam has open foreign investment policy

Vietnam always opens its market and encourages foreign investors by updating and adjusting investment regulations. Therefore, many preferential policies are applied to attract investors such as exemption in corporate income tax and import tax, reduction in land rental and land use, etc. Besides, administrative procedures are reformed to create favorable conditions for investors.

1.5. The business environment is constantly improving

Vietnam’s business investment environment is constantly improving towards transparency and conformity with international standards.

Vietnam has joined many bilateral and multilateral free trade agreements with many countries and regions such as the United States, Korea, Japan, ASEAN, CPTPP, EVFTA, which provides a plethora of advantages to investors coming from these countries upon entering Vietnam.

Vietnam - EU FTA Agreement

Bilateral Trade Agreement - United States (BTA)

Member of the World Trade Organization (WTO)

Member of the ASEAN Free Trade Area (AFTA)

1.6. Enhance the competitiveness

The Vietnamese government is making concerted efforts to improve the country’s competitiveness. In 2019, the United Nations Industrial Development Organization (UNIDO) ranked the global competitiveness of Vietnam’s industry as increasing from the 58th position in 2015 to the 42nd position in 2019. Vietnam reached 70th position in terms of economic environment sales in 2019 and 67th in Global Competitiveness 4.0 (up 10 levels compared to 2018).

1.7. Progressing Infrastructure

Previously, transportation infrastructure was identified as one of the causes creating invisible barriers in the process of attracting FDI into Vietnam. However, in recent years, the government and localities have been actively deployed to attract all resources to improve infrastructure, arterial traffic routes, airports, border gates, borders, economic zones, and industrial zones.

1.8. Young and educated workforce

As a country with a young population (an average age of 33.3) in addition to its youth, the Vietnamese labor force is highly appreciated for its patience and level of education. In comparison to other countries, Vietnam has developed its education and training programs and institutions. This is one of the competitive advantages of Vietnam compared to other labor markets in the region to attract foreign investment.

2. Features

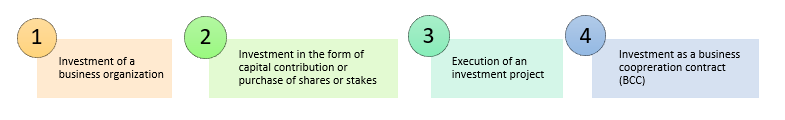

Investment forms recognized as foreign-invested business

3. Purpose of operation

Foreign-invested enterprises, in general, exercise their rights and obligations in accordance with Vietnamese law and are entitled to preferential policies, especially in the form of incentives and tax rates.

Foreign-invested business development is associated with the goals of global economic cooperation and expanding markets for business activities around the world. It might affect Vietnam’s economy in many aspects, such as trade revenue, infrastructure development, technology transfer, or long-term cash flow.

4. Challenges

4.1. Business investment industry

Regarding Vietnam’s WTO commitment and Vietnam’s legal regulations, it may be challenging for foreign investors to register unopened trades or industries with investment restrictions.

4.2. Conditions of investors

Some lines of business require specific investment conditions in terms of investment status, which must be individuals or organizations, which can be determined through a combination of investment conditions for all businesses. sectors/lines of investment registered on the basis of the scope of Vietnam’s commitment and the provisions of Vietnamese law (if any).

4.3. Investment capital to establish a foreign- invested business in Vietnam

Currently, Vietnam’s market-opening commitments and Vietnamese law only stipulates that the investment limit conditions of projects to establish foreign-invested companies in certain fields, such as education, business, real estate, travel, payment intermediaries…; Other normal business lines do not regulate investment limit. Accordingly, investors will need to ensure the feasibility of the amount of investment capital commensurate with the scope and scale of the project.

4.4. Procedures for establishing a foreign-invested company

During the process of performing the procedures for establishing a foreign-invested company, the enterprise must declare a series of documents relative to the declaration and verification of the source of capital from the foreign unit investing in the enterprise being established. These documents are in accordance with the provisions of Vietnamese law, forcing foreign-invested enterprises to establish a company that strictly complies.