Converting a single-member limited liability company and a multiple-member limited liability company into a joint-stock company is not too difficult. One may easily convert the type of business by following the procedures and documents in the order given below.

1. Procedures and application for converting a single-member limited liability company into a joint-stock company

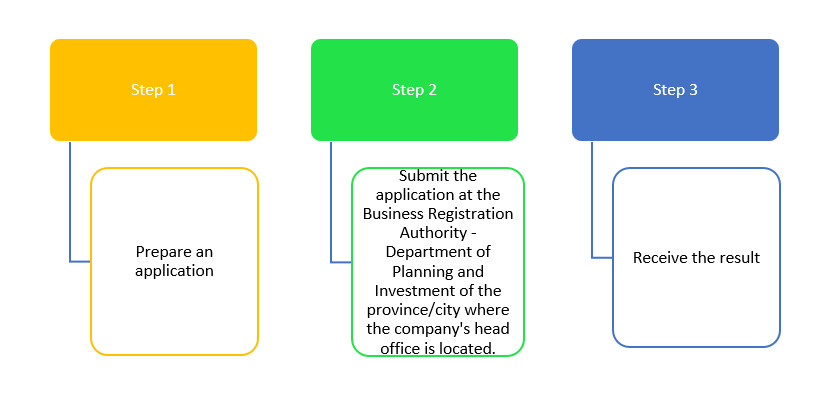

Businesses are required to follow the steps, below, to convert a limited liability company into a joint-stock company:

Within 10-days from the date of completion of the conversion, the enterprise must make an application and submit it to the Department of Planning and Investment to register the conversion of the company type.

The application includes:

- Application form for enterprise registration;

- New charter for the converted company;

- The list of founding and foreign shareholders (all capital contributors post change);

- Decision of the company’s owner (a single-member limited liability company) or decision with a minutes of meeting of the Board of Members/Partners (a multiple-member limited liability company) on the conversion in the type of company;

- Contract for the transfer of capital shares;

- Documents certifying capital contribution of new members and shareholders;

- Written approval from the Investment Registration Authority on capital contribution, share purchase, purchase of capital contributions from foreign investors, or foreign-invested business organizations (if any);

- Notarized personal identification documents (i.e. Citizen identification cards, National identification cards, passports, or other legal personal identification of founding shareholders;

- Power of attorney for the person submitting the application (if any).

2. Processing time

The company registration office requires 5-business days from the date of receipt of the enterprise’s conversion application. If the application is valid, the authority will re-issue a new business registration certificate. illegitimate applications will result in a notice requiring amendment and supplementation of the registration application for the enterprise and the company will need to re-submit the applcation.

3. Notes

A limited liability company may be converted into a joint-stock company under the following scenarios:

Scenario no. 1: Limited company with three (3) or more members into a joint-stock company; with the original capital contributors remaining unchanged.

Under this scenario, the company has enough members to convert to a joint-stock company, however, the number of initial capital contributors remains unchanged (no additional capital contribution, no sale of contributed capital to other organizations or individuals), and the capital contribution ratio of the former members may change or remain unchanged, members remain the former.

Scenario no. 2: A single-member limited liability company, a multiple-member limited liability company (only 2 members contribute capital) into a joint-stock company.

Under this scenario, the enterprise needs to mobilize other organizations and individuals to contribute capital to change the type of enterprise (because a joint-stock company is required to have three (3) or more shareholders).

Scenario no. 3: A single-member or multiple-member limited liability company into a joint-stock company, there is a change in the capital contributors as well as the amount of contributed capital.

In case a single-member limited liability company or a multiple-member limited liability company can sell all or part of its contributed capital to another company in order to add new organizations and individuals as shareholders, and at the same time rotate and contribute more capital, it can sell all or part of its contributed capital to one or several other organizations and individuals. As long as the company has 3 or more shareholders as prescribed, which is required by law. The capital contribution ratio in this case also changes.

Scenario no. 4: Combination of all three previously mentioned scenarios.

A single-member or multiple-member limited liability company may simultaneously transfer or sell the contributed capital to a new organization or individual and receive a new organization or individual to contribute additional capital. In this event, there will be changes in the information about shareholders contributing capital and the capital contribution ratio.

Please contact us for more information and/or concerns regarding the procedure to convert a limited company into a joint-stock company. Our team of legal experts may be contacted at +84-916-545-618 or by email hung.le@cnccounsel.com and thanh.tran@cnccounsel.com for further support.