There is a common misconception that foreign citizens or companies cannot own property in Vietnam. In reality, it is possible, however, there are certain conditions that you need to bear in mind when buying property in Vietnam.

We have put together this guide to shed light on ways how foreign investors can obtain property in Vietnam.

Foreign ownership of land in Vietnam

There is a different form of land ownership in Vietnam than in most other countries. In Vietnam, the land belongs to all the people and is managed by the state.

In other words, even the Vietnamese themselves cannot own land in Vietnam as it is collectively owned by all. This is a different concept of public and private ownership of land that is used in most jurisdictions.

Consequently, this arises a mistaken belief that foreign citizens or companies cannot own any property in Vietnam. What you can do, however, is that you can obtain the right to use land in Vietnam which is very similar to having ownership rights.

Who can lease land in Vietnam?

Citizens of Vietnam, local organizations or foreign-owned companies can purchase the right to use land and to build on it.

The length of a lease agreement that allows you to use land in Vietnam depends on the government. In general, the maximum length is 50 years and it is also possible to renew the agreement for another 50 years.

How to buy property in Vietnam

1. Set up a 100% foreign-owned company in Vietnam

The first option to buy property in Vietnam is to set up a fully foreign-owned company. With a foreign company, you can purchase apartments or houses in Vietnam for a limited term.

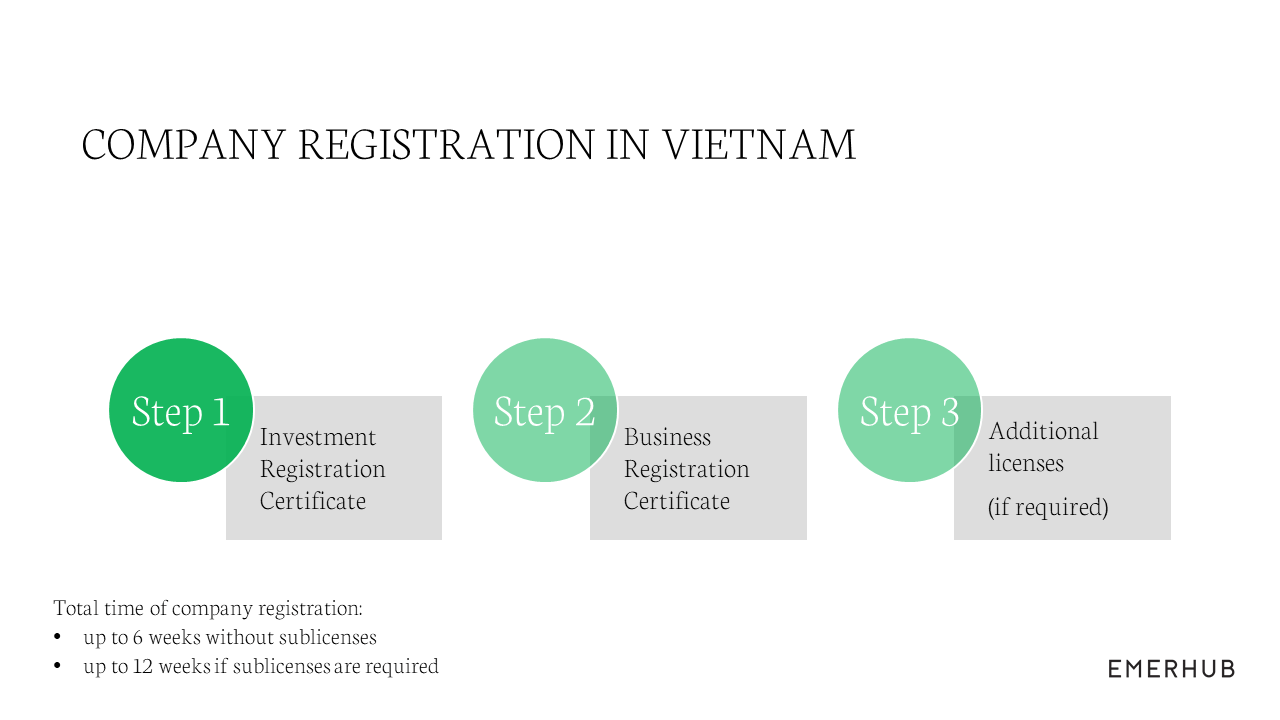

The process of company registration in Vietnam is generally the same for all foreign investment companies and takes approximately 4-6 weeks if you don’t need any additional licenses.

During this time you will first acquire an Investment Registration License from the Department of Planning and Investment (DPI). This certificate allows you to start doing business in Vietnam.

The second step of incorporation in Vietnam is to obtain a Business Registration Certificate. Note that once you have received a business registration certificate from the DPI, you have 90 days to make the initial capital contribution.

Depending on your business line, you may also need additional licenses. For example, if you plan to sublease your property, you need a separate license for engaging real estate business in Vietnam. This will add some additional time to the company registration.

Note that foreign individuals or companies cannot own more than 30% of apartments in one apartment building. They also cannot own more than 250 separate houses including villas and row houses in areas where the population is equivalent to a ward-administrative division.

Length of foreign company’s lease agreements

Foreign-owned companies can hold lease agreements in Vietnam until the end of the duration of their Investment License which is usually granted for ten years.

The Investment License is renewable. However, make sure you keep your company in compliance and report taxes in Vietnam in a timely manner to ensure that there will be no issues with the extension.

You can also sell your property to another buyer. However, it is important that you also include the clause of ownership extension in the sales contract.

If your company is planning on buying property in Vietnam, get in touch with us via hi@gate2v.com. We will assist you with processing the extension and help you keep your company in compliance.

2. Form a joint venture in Vietnam

Another option to buy property in Vietnam is to form a joint venture with a Vietnamese shareholder.

Locally-owned companies and Vietnamese citizens can purchase:

Households;

Buildings for sale, lease, or lease-purchase; and

Entire or part of real estate project to build buildings for sale, lease, or lease purchase.

The term of the agreement for Vietnamese citizens is indefinite. Local companies, on the other hand, can hold ownership of the property until the termination of the company.

However, be sure not to use an unreliable nominee as it is one of the common mistakes foreign investors do when starting doing business in Vietnam. Instead, enter into a joint venture agreement with a trusted local partner such as Gateway to Vietnam.

3. Buy a house or an apartment as an individual

Foreign nationals who are residents in Vietnam can also buy dwelling houses without forming a legal entity.

However, as an individual, you can only purchase a house or an apartment for your own use. That means that you cannot rent it to third parties.

The term of ownership will be set in a housing sale agreement, but not for longer than 50 years per term. Lease agreements are renewable and upon sale, we suggest you also agree with the seller that:

Renewal of the agreement is for free and no additional rent will be collected for the next lease period. Processing of renewal is for free. If the law on foreign ownership changes, the transfer of ownership to you will not include extra charges.

This type of an agreement is a common practice in Vietnam as it is the closest available arrangement to private ownership. Only keep in mind that when acquiring property this way, you can only use it for residential, not for subleasing purposes.

4. Setting up a real estate business in Vietnam

It is important to note that companies that are not registered with the real estate business line can only buy property for company’s own use. For example, for accommodating their employees.

If you also plan on subleasing the real estate you’re going to acquire, you need to have a company that is registered under the real estate business line as well.

With a real estate company in Vietnam you can:

Lease units or buildings for sublease;

Build, lease or sell a residential and non-residential property on land leased by the government; or

Construct, lease or sell residential and non-residential property of a commercial real estate project

5. Allowed foreign ownership of real estate companies in Vietnam

There is no limitation on foreign ownership of real estate companies. Therefore, foreign investors can set up 100% foreign-owned real estate businesses in Vietnam.

6. The minimum capital requirement for real estate businesses in Vietnam

Unlike in most business lines in Vietnam where you can register a company without an official prerequisite on minimum input, the real estate trading classification also has a minimum capital requirement.

In order to set up a real estate business, you need to have 20 billion VND (~US$ 880,000) of minimum capital. However, note that this investment can be non-monetary. This means that you can also register property and other assets as part of the capital.

7. Getting started with buying property in Vietnam

When planning on buying property or setting up a company in Vietnam, it is wise to seek legal advisory beforehand. This way you will eliminate the possibility of bad surprises in the future.

Get in touch with us via the form below or visit our company registration page. Our consultants at Gateway to Vietnam will provide the necessary support.