Currently, joint-stock companies are one of the most popular types of enterprise that many people have taken an interest in. Individuals and organizations that intend to establish large-scale businesses often choose this type of enterprise as a Joint Stock Company because it has outstanding advantages.

Through this article, a Client will gain a better understanding of the basic characteristics of a Joint-Stock Company, allowing you to select the appropriate business type.

1. What is Joint-Stock Company?

A Joint-Stock Company is a type of enterprise in which shareholders contribute business capital and are responsible – within their contributed capital – for voluntarily conducting production and business activities to earn a profit.

2. Characteristics of Joint-Stock Company

Besides having common characteristics compared with other types of enterprises, Joint Stock companies also have many outstanding characteristics to distinguish them from other types of enterprises.

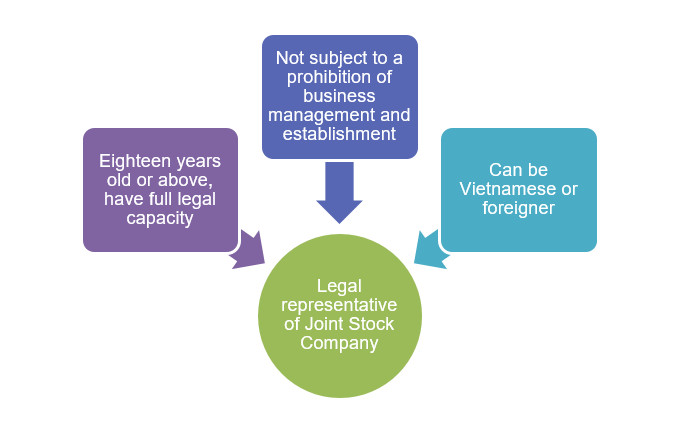

2.1. Legal representatives of Joint Stock Company

A Joint Stock Company may have one or more legal representatives.

An enterprise must have at least one legal representative residing in Vietnam.

If a Joint Stock Company has a legal representative, the President of the Board of Directors or the Director or General Director is the legal representative of the company. If the Charter doesn’t have any provisions, the President of the Board of Directors is the legal representative of the company.

In case a company has more than one legal representative, the President of the Board of Directors and the Director or General Director are automatically the legal representative of the company.

2.2. Types of shares in a Joint Stock Company

- The 2 types of shares in a Joint-Stock Company consist of Ordinary shares and Preference shares“Preference shares” include participating preference shares; redeemable preference shares; super-voting shares; and other types of preference shares prescribed by the company’s charter and securities laws.Individuals or organizations that own shares are called shareholders. Owners of shares of the same type have the same rights, obligations, and interests.

2.3. Shareholder in a Joint Stock Company

- In contrast to a multiple-member limited liability company, a Joint-Stock Company requires only a minimum of three shareholders, not a maximum. Therefore, the company has the flexibility to increase the number of owners contributing capital as needed.There are 3 types of shareholders:

2.4. Ability to mobilize capital of a Joint Stock Company

The primary benefit of a Joint Stock Company in raising capital is that there is no limit to the number of shareholders who can contribute capital, the right to openly sell shares to the public and to borrow capital from the public by issuing bonds.

Not only that, the procedure for transferring shares in the company is by no means difficult, as shareholders have the right to freely transfer their shares, except in some cases as prescribed by the Law on Enterprise.

Therefore, individuals and organizations can join or leave the company at any time provided that such activity complies with the laws and the company’s charter. The capacity to mobilize capital widely and flexibly has given Joint-stock Companies an advantage over other types of enterprises.

A Joint Stock Company has the following forms of capital mobilization: offering shares to existing shareholders; private placement of shares; and offering shares to the public.

2.5. Organization structure of a Joint-Stock Company

A Joint-stock Company usually operates under one of the following two organizational management models:

Model 1: A Joint-stock company with the GMS, Board of Directors, Board of Controllers and Director/General Director. If the Joint-stock company has fewer than 11 shareholders and the shareholders – which are organizations – hold less than fifty-percent (50%) of the company’s total shares, a Board of Controllers is not mandatory.

Model 2: A Joint-stock company with the GMS, Board of Directors, and Director/General Director. In this case, at least twenty-percent (20%) of the members of the Board of Directors shall be independent members and there has to be an audit committee affiliated with the Board of Directors.

2.6. Asset liability regime of a Joint Stock Company

The administration of the asset-liability of shareholders of a Joint Stock Company is a limited liability and separate between the company’s assets and the personal assets of shareholders. It means:

- The company will be liable for all of its assets for debts and other property obligations. And,

- Shareholders are only liable for the amount of capital (shares) they own. That is, the more shares a shareholder owns, the more responsible they are. When a company makes a loss and incurs debts, shareholders only lose the money used to purchase shares; personal assets are unaffected.

3. Advantages and Disadvantages of a Joint Stock Company

From the basic characteristics of a Joint Stock Company, we can easily see the advantages and disadvantages of this type of enterprise as follows:

The characteristics, advantages, and disadvantages of a Joint Stock Company have been discussed above. Any questions regarding the choice of a business type or the need for CNC’s assistance with legal matters relating to a Joint Stock Company, please contact hotline+84-916-545-618 or email hung.le@gate2v.com.