Vietnamese companies desiring to transfer stakes and/or shares to foreigners who does not hold Vietnamese nationality needs to base itself on the provisions of Vietnamese law and the trade agreements signed by Vietnam to see with the industry. For the benefit of our clients, we would like to explain the basic rules of the law regarding the transfer of contributed capital and shares to foreigners.

1. Form of buying stakes, shares

Foreign investors receive the transfer of stakes and shares from members and shareholders of the company in the form of buying stakes or shares from members or shareholders of the company that investors want to invest in.

Specific forms of buying shares and buying contributed capital.

2. Obtaining registration to buy stakes and/or shares

Investors must perform a set of procedures to register to purchase it with state agencies if the investment in a Vietnamese company falls into one of the following cases:

The capital contribution or purchase of shares or stakes increases the ownership ratio by foreign investors in a business organization conducting business in the restricted business lines;

The capital contribution or purchase of shares or stakes results in a foreign investor or business organization holding more than fifty percent (50%) of the charter capital of the business organization in the following situations:

- The holding of charter capital by the foreign investor is increased from less than or equal to fifty percent (50%) to greater than fifty percent (50%);

- The holding of charter capital by the foreign investor is increased while such foreign investor is holding more than fifty percent (50%) of the charter capital of the business organization.

The foreign investor that contributes capital and/or purchases shares or stakes of a business organization has a certificate of rights to use land on an island or in a border or coastal commune; in a coastal commune; in another area that affects national defense and security.

3. Transferring of stakes and/or shares to foreigners

Step 1: Investors perform the procedures for registration of capital contribution and/or purchase of shares or stakes to a Vietnamese company at the Department of Planning and Investment.

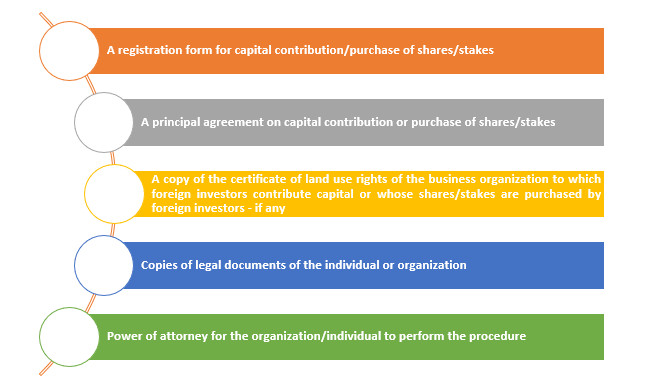

Documents to prepare:

Applications meeting the criteria of the Department of Planning and Investment will result in a written notice being sent within 15-days from the receipt of the valid application. Applications NOT meeting the criteria of the Department of Planning and Investment will result in a written notification outlining the specific reasons why the application is invalid.

Step 2: After approval has been granted the Investment Department – Department of Planning and Investment on the approval for foreign investors to buy stakes or shares, the investor performs the procedures for the change of members or shareholders at the business registration authority.

In situations in which the investor is not in a position to carry out the procedures for registration of capital contribution or purchase of shares or stakes, the investor must follow procedures for changing shareholders/members as prescribed by law when contributing capital and purchasing shares or stakes of business organizations.

4. Notes when transferring of stakes, shares to foreigners

- Within 10-days from the date of transfer, the Vietnamese member or shareholder transferring the contributed capital to a foreigner must submit a PIT declaration to the competent tax authority.

- For joint-stock companies, the transferor must submit both a personal income tax return and pay a personal income tax of 0.1-percent (0.1%) on the transfer value.

- For a limited company, the transferor only needs to submit a personal income tax return within 10-days from the date of completion of the transfer.

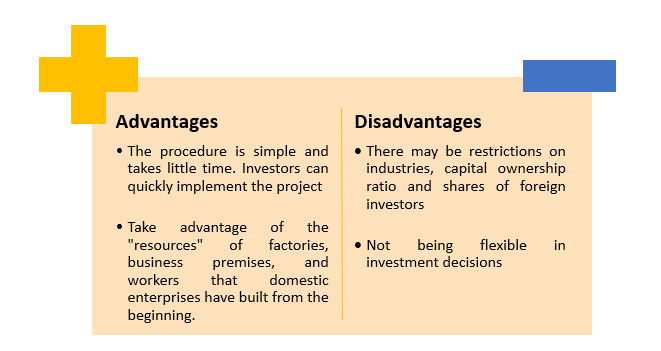

5. Advantages and disadvantages of various methods of transferring stakes, shares

When transferring stakes and/or shares to a foreign investor, or when a foreign investor capital contribution and purchases of shares or stakes, the investor must first determine if the enterprise does business. Is there a cap on capital contributions and in which fields?

When transferring stakes and/or shares to a foreign investor, or when a foreign investor capital contribution and purchases of shares or stakes, the investor must first determine if the enterprise does business. Is there a cap on capital contributions and in which fields?

If an investor wants to buy stakes and/or shares in a business enterprise in a line of business where foreign investors are restricted from contributing capital, and the percentage of contributed capital by foreign investors exceeds the permitted range, the investor should consider not buying or buying fewer shares to ensure conditions. Or if the enterprise wants to transfer stakes and/or shares to foreign investors, it must follow procedures to ensure conditions.

Please contact us at +84-916-545-618 phone number or email hung.le@cnccounsel.com and thanh.tran@cnccounsel.com to obtain legal advice and or assistance from our team of legal professionals.