When the COVID-19 pandemic hit Ho Chi Minh City, last year, the government ordered the closure of all businesses with the exception being for that of essential commodities. Mass gatherings had to be limited, people were not allowed venture outdoors unless necessary, and all aspects of social life were seriously impacted.

Instead of being dissolved, businesses had the option of a business suspension for a specified length of time, after which it would be able to resume normal operations.

1. Business suspension defined

A business suspension is when an enterprise suspends its business operations for a certain period of time due to various reasons such as financial difficulties, labor, etc., and is temporarily unable to continue business operations, and needs time to rearrange work, reassess finances, and perhaps restructure their operations.

2. Procedures for business suspension

The enterprise must submit written notification of the time and duration of the suspension to the business registration agency at least three (3) days prior to the planned date of suspension.

The notification must be enclosed with the resolution or decision and a copy of the minutes of the meeting of the Board of Members (for multi-member limited liability company) or partnership, of the Board of Directors (for joint-stock company), or the resolution or decision of the owner on business suspension for a single-member limited liability company.

Competent state agency: Business Registration Office – Department of Planning and Investment

Processing time: Three (3) business days from the date of submission of a valid application

3. Duration

While there is now limit as to the number or frequency of business suspensions, each suspension MUST NOT exceed one year. For example, if a business has been operating without a business plan for a long time but does not wish to disband, it must notify the business registration office.

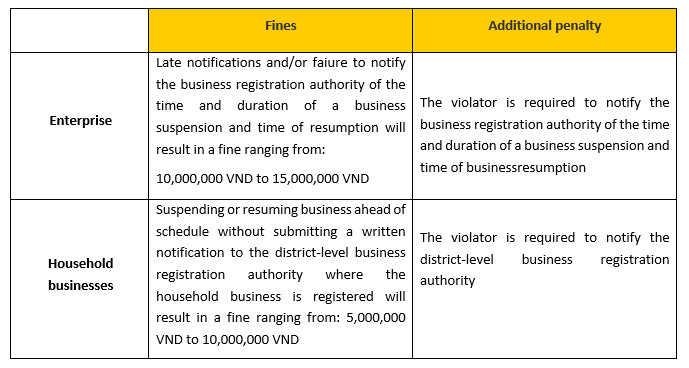

4. Penalties

The taxpayer is not required to submit tax declaration dossiers unless the suspension begins in the middle of a monthly/quarterly/annual tax period, in which case the tax declaration dossier of that month/quarter/year must be submitted.

For household businesses and individual businesses paying presumptive tax, tax authorities shall decide the tax payable upon their suspension in accordance with regulations of the Minister of Finance.

The taxpayer must not use invoices and is not required to submit invoice use reports. Whenever the taxpayer is permitted by the tax authority to use invoices in accordance with invoice laws, the taxpayer shall submit the tax declaration dossier and invoice use reports as per regulations.

The taxpayer is required to implement the tax authority’s decisions and notices of debt collection, enforcement of tax decisions, inspections of compliance to tax laws, and administrative penalties for tax offenses in accordance with the Law on Tax administration.

The above is information pertains to the procedures for a company business suspension. For assistance in completing a procedure or to clarify the procedures, you may contact our team of legal experts via phone number +84-916-545-618 or email hung.le@cnccounsel.com and thanh.tran@cnccounsel.com for further assistance.