A partnership is a unique business model with a small number of practitioners in the Vietnamese business community, but its benefits in a variety of business lines and areas cannot be denied.

Therefore, it is impossible to ignore the type of partnership company when investors consider choosing a type for the company. With the system of general partners who must be jointly responsible with their entire assets for debts and other financial obligations, many people mistakenly believe that a partnership has no legal status due to the failure to separate information between personal and corporate assets.

Concept

A partnership is a type of business in which the members do business under the same name and are jointly. And severally liable with all of their assets for the company’s debts and obligations incurred in the course of the company’s business activity.

The members of a partnership must fully understand and trust each other due to the shared nature of infinite property liability. In actuality, the company’s general partners are family members or close friends.

Members of partnerships

Because of the responsibility for all of their assets, a general partner is not allowed to exercise the following rights:

A general partner must not be the owner of a sole proprietorship; must not be a general partner of another partnership unless it is accepted by the other general partners.

A general partner must not, in their own name or others’ names, do business in the same business lines as those of the partnership for personal gain or to serve the interests of another organization or individual.

A general partner must not transfer part or all of his/her stake in the company to another organization or individual unless it is accepted by the other general partners.

In addition to general partners, the company also has limited partners

Limited partners are organizations or individuals and only take on liability for the partnership’s debts and other liabilities which are equal to their promised capital contribution. This is the mode of limited liability of limited partners.

Limited partners do not participate in administrative activities of the partnership and do not partake in business activities under the partnership’s name.

Limited partners comply with the partnership’s charter, resolutions, and decisions of the Board of Partners.

Characteristics of a partnerships

Legal Entities

A partnership has the status of a juridical person from the day on which the Certificate of Enterprise Registration is issued.

Capital Mobilization

Just like sole proprietorships, partnership must not issue any kind of securities.

This has several drawbacks for members of the company who want to raise more capital. General partners, on the other hand, can raise extra capital by increasing member capital contributions or receiving capital contributions from new members.

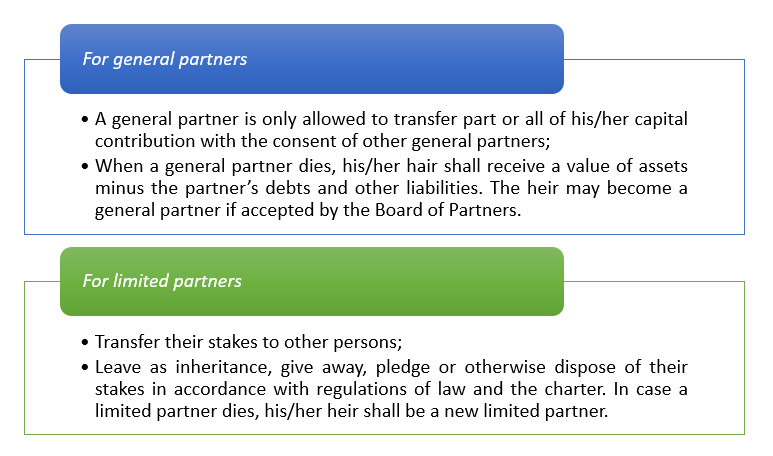

Transferring a partnership's stakes

Organizational structure of the partnerships

In general, the organizational structure of a partnership is similar to that of a limited liability company with 2 or more members with the structure of the Board of Partners.

The Board of Partners consists of all members. The Board of Partners shall elect a general partner to be the Chairman of the Board of Partners and concurrently the Director or General Director of the company, unless otherwise provided for in the company’s charter.

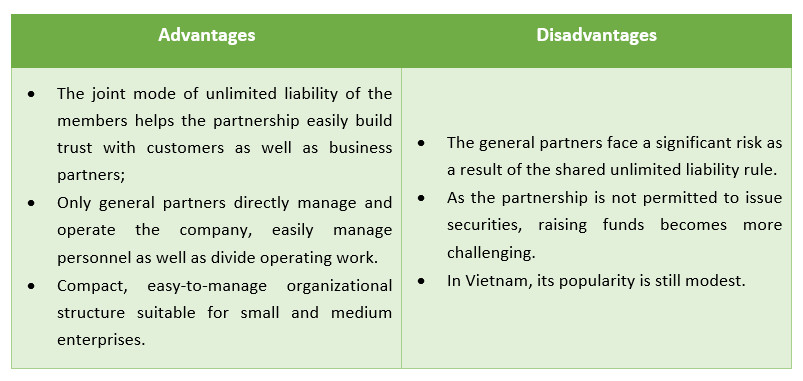

Advantages and disadvantages of partnerships

The above is information regarding the characteristics, advantages and disadvantages of a partnership. If you are still wondering about choosing the type of business, establishing a partnership or have any questions, need our advice on legal issues related to a partnership, please contact hotline +84-916-545-618 or email hung.le@gate2v.com.